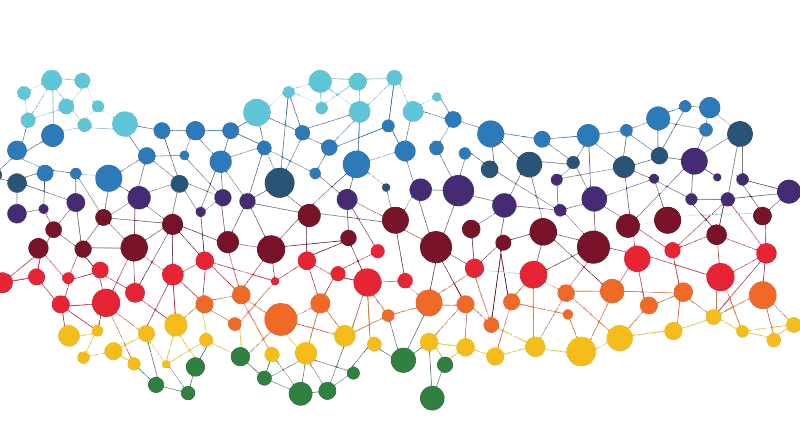

Turkish Iron and Steel Sector

World crude steel production growth slowed down to its lowest level of 1.2 % since 2009 and increased from 1,529 billion tons to 1,548 billion tons. The growth came mainly from Asia and North America while crude steel production in the EU27 and South America decreased in 2012 compared to 2011. The role of China in world crude steel production rise continued to ease in 2012 as the crude steel production of China increased by just 3.1 % to 717 million tons. Production drops in some regions like EU, CIS, South America has drawn back the world crude steel production growth rate to 1.2 % level. Among the top steelmakers, production of Japan, Germany, Brazil, Ukraine and Italy slumped compared to 2011.

The sharpest production drop in 2012 was in EU 27 due to the downward trend in steel consumption as a result of the continued effects of the debt crisis on the investments and steel demand in the Europe. Crude steel production of the EU which dropped by 4.7 % compared to 2011, stayed 20 % below its production in the pre-crisis period of 2007. In addition to the EU, CIS, North America and South America are the regions which have not been able to reach their pre-crisis levels yet.

Large steel producers like Japan, USA, Russia, Germany, Ukraine, Italy, France and Spain have also produced less steel compared to 2007. During the last five years, highest production growth were seen in China (46 %), India (43 %), Turkey (39 %) and South Korea (35 %). With the support of those countries, global crude steel production increased by 15 % compared to the pre-crisis period.

Despite production growth in 2012, average capacity utilization ratio of the world steel industry in 2012 declined to 78.8 % compared to 80.7 % in 2011. The declining tendency in the capacity utilization ratio of the world steel industry throughout the year from 80 % level in the first quarter to 73 % in December dragged down the annual capacity utilization in 2012.

Crude Steel Production

Turkey’s crude steel production grew by 5.2% to 35.89 Mt in 2012. Turkey moved up to the 8th position in the largest steel producing countries list from the 10th position in 2011 overtaking Brazil and Ukraine. Despite sharp drop in crude steel production growth from 17 % in 2011 to 5.2 % in 2012, Turkey kept its position as the country with the highest production increase in the top 10 steel producers. Although crude steel production increase slowed down, Turkey’s growth rate was 4.5 times higher than the world average of 1.2%. Quarterly production figures for 2012 clearly reflects the slowdown in production growth. Growth rate of the Turkey’s crude steel production was 13.7 % yoy in the first quarter. Increase in the production slowed down to 5.2 % in the second quarter, 6.7 % in the third quarter, growth tendency turned to negative during the last quarter and production dropped by -3.6 %. Recent figures show that Turkey increased its production compared to the pre-crisis period by 39 % and in this respect was among the 5 countries to carry its production to 2007 level.

Billet played a significant role in Turkey’s crude steel production growth. Turkey’s billet production rose by 10.9 % to 27.05 million tons. Slab production, which grew by 53 % in 2010 and 33 % in 2011 due to the new capacities established, dropped down by 9 % to 8.8 million tons due to the unfavorable conditions in flat steel markets, increasing competition, unfair trade from some of the Far East countries and low quality steel import from some of the neighboring countries. In this respect, share of slab in Turkey’s total crude steel production dropped from 28.5 % in 2011 to 24.6 % in 2012, which means a large part of the capacity kept underutilized in 2012.

While crude steel production of the EAF mills increased by 5.1 % to 25.56 million tons, production growth in the BOF route stayed around 5.6 % reaching 9.33 million tons.

Capacity and Capacity Utilization

Turkey’s crude steel production capacity reached 49.04 million tons in 2012, up by 4.1 % yoy. While electric arc furnace mills accounted for 100 % of the total increase in capacity, share of EAF mills in total crude steel production capacity reached 78 %. Due to the slowdown in crude steel production growth compared to the capacity, average capacity utilization ratio of the Turkish steel industry dropped 1 percentage points to 75 % in 2012.

Finished Steel Production & Consumption

Turkey’s total finished steel production increased by 7.3 % yoy from 31.94 million tons to 34.28 million tons in 2012. While long steel production expanded by 10.4 % to 25.2 million tons, the reflections of the slowdown in slab production and flat steel market is seen in flat steel production of Turkey. As slab import reached record high of 950.000 tons in 2012, the drop in Turkey’s finished flat steel production was more moderate than the sharp drop in slab production. As a result long steel accounted for 73.6 % of the total finished steel production of Turkey and flat steel accounted for 26.4 % of the total.

Turkey’s apparent finished steel consumption reached 28.5 million tons up from 26.93 million tons by 5.6 %. Turkey’s steel consumption growth pace slowed down sharply in 2012 in parallel to the economic activities, after growing at double digit rates in 2010 and 2011. While total consumption in long products which are generally used by the construction industry grew by 7.9 % to 14.83 million tons, apparent consumption in flat steel products which are generally used by automotive, machinery, white goods and shipbuilding industries reached 13.63 up by 3.1 %. Slower growth rate in flat steel consumption compared to the long steels reflects the stagnation in manufacturing industry.

Production/consumption ratio of Turkey in flat products reached 69 % in 2012 from 40 % in 2005. However, the ratio dropped to 66 % in 2012, due to the growth in consumption but drop in production. Production/consumption ratio in long products increased from 166 % in 2011 to 170 % in 2012.

Economy

After completing 2011 at a higher growth rate of 8.8 %, Turkish economy entered a period of slowdown beginning from the last quarter of 2011 and grew by just 5 % in the final quarter of the year. Slowdown in GDP growth pace continued throughout 2012 and Turkish economy grew by 3.4 percent in the first quarter, 3.0 percent in the second quarter, 1.6 percent in the third quarter and 1.4 percent during the final quarter of 2012. Growth rate of the Turkish economy dropped sharply to 2.2 % in the whole of 2012 from 8.8 % in 2011. While market stagnation played an important role in the sharp slowdown of the economic growth, the losses in domestic sales were partly compensated by the increasing export sales to meet the foreign demand. Slowing growth pace of the Turkish economy enabled the current account deficit of Turkey, which is considered as the most fragile part of the Turkish economy, drop by 28.3 billion USD (36.7 %) yoy to 48.8 billion USD compared to 2011.

Inflation completed the year at one digit rates again and rise in PPI was at 2.45 % and CPI at 6.16 %. Unemployment rate declined to 9.2 % in 2012 which is 0.6 percentage points lower than 2011 level. Foreign trade deficit of Turkey dropped from 105.9 billion USD in 2011 to 84 billion USD in 2012, down by 20.7 % yoy. Turkey’s total export value grew by 13.1 % to 152.6 billion USD in 2012, while import dropped by 1.8 % to 236.6 billion USD. Sharp drop in foreign trade deficit played the major role in the 37 % contraction at the current account deficit.

Export

Turkey’s total iron and steel exports, including the articles of steel and steel pipes reached 20.3 million tons from 18.5 million tons up by 9.6 % in terms of tonnage and up by 3.3 % to 17.2 billion USD in terms of value. While billet export reached 3 million tons level up by 24 %, flat steel export dropped by 19 % to 1.86 million tons mainly due to the lower export sales to the EU region as a result of the sharp drop in the consumption of the region. Long steel export of Turkey, which has traditionally been the largest export product group, reached 11.7 million tonnes up by 11.8 % yoy. In the whole of 2012, while long steel accounted for 58 % of Turkey’s total steel export, the share of semis was 15 %, tube and pipes 9.3 % and flat steel products 9.2 %.

Turkey’s total steel export to the Middle East and Gulf Region and North Africa recovered in 2012 partly depending on the stability in the economic, social and political climate of the region. Turkey’s total steel export to the Middle East and Gulf countries increased by 27 % to 9 million tons and export to the North Africa grew by 16 % to 2.1 million tons. While the share of the two regions in Turkey’s total steel export increased from 48 % in 2011 to 56 % in 2012, share of the EU region dropped sharply from 19.9 % to 12.4 %.

Import

While Turkey’s total steel import, including the articles of steel and steel pipes, increased by 10.8 % to 11.84 million tons in terms of tonnage, value of import dropped by 5 % to 11.23 billion USD due to the fall in average price levels. 2012 import data show that Turkey’s semis import soared by 56 % and flat steel import stayed at high levels of 2011 despite production capacity well over the demand. In addition to the high levels in flat steel imports, low demand in the main export markets especially EU region, put pressure on the flat steel production of Turkey. Furthermore, despite Turkey has two times more capacity than its consumption in long steel products, Turkey has imported around 1.3 million tons of long steel products, which reflects the free market structure in the Turkish steel industry.

When steel import is analyzed in terms of regions, it is clearly seen steel export of the EU to Turkey increased by 16.7 % to 5.2 million tons in terms of tonnage and reaching 5.5 billion USD export value, while EU imported less steel from Turkey. In addition to the EU, Turkey’s total steel import from the CIS region also rose by 9.5 % to 4.6 million tons and import from the Far East & Southeast Asia strengthened by 4.7 % to 1.4 million tons. In 2012, EU and CIS accounted for 83 % of Turkey’s total steel import.

Steel Trade Balance

,Steel products accounted for 11.3 % of the Turkey’s total export in 2012 with its total export value of 17.15 billion USD. With the support of stronger growth in exports, Turkey’s steel product export/import ratio recovered from 141 % in 2011 to 153 % in 2012. Successful performance in other steel products played significant role in the improvement of the export/import ratio by 12 percentage points balancing the negative effects of the flat steel products. Turkey’s net steel export rose from 7.8 million tons to 8.5 million tons in terms of tonnage and from 4.8 billion USD to 4.9 billion USD in terms of value.

Turkey continued to have deficit in its steel trade with the EU and CIS regions, despite surpluses in trade with the other regions. In 2012, Turkey’s net steel import from the EU climbed from 1.4 billion USD to 2.4 billion USD and net import from the CIS region gone to the 2.5 billion USD level. Turkey’s total net steel import from the EU and CIS regions reached around 5 billion USD level.

Raw Materials

Turkey’s total ferrous scrap consumption increased by 5.1 % to 32.4 million tons in 2012 when Turkey’s total crude steel production rose by 5.2 % and EAF crude steel production soared by 5.1 %. Turkish steel industry met 22.4 million tons of its total scrap consumption through import and 10 million tons from the domestic market. In 2012, share of local scrap consumption of the Turkish steel industry recovered by 1 percentage points to 31 % of the total. EU accounted for 51 % of Turkey’s total scrap import, while the share of USA was 28.1 % and Russia 10.4 %.

In addition to scrap, which has the highest value among the imported raw materials, Turkey also imported 7.8 million tons iron ore, 1.4 million tons pig iron, 428.000 tons ferro alloys and 4.6 million tons coking coal.

Forecasts

Turkish economy is forecasted to grow by 4 % in 2013. With the help of the increasing market demand, Turkey’s crude steel production is expected to rise by 6 % to 38 million tons level. In 2013 finished steel production is forecasted to pass 37 million tons level and consumption to reach around 30.5 million tons. Expected recovery in the construction industry which accounts for around half of Turkey’s total steel consumption, growth oriented government policies, drop in loan interest rates and production growth of the manufacturing industries which consume steel products for their production will be the main drivers of the Turkey’s steel consumption in 2013.

Turkish steel industry, which traditionally exports half of its production, is estimated to export around 22 million tons of steel in 2013 up by 6 %. In 2013, EU market is expected to continue gradual recovery from the low points of activity seen in 2012; partial stability is expected be established in the Middle East region; more steady demand conditions in the Far East region, is expected to support stability in the international markets. Turkey’s steel export to the Middle East and Gulf region is expected to continue growing; export to the countries in Africa and Far East which are specified as the target markets by the Turkish Steel Exporters Union is also forecasted to continue improving.

Success of the efforts to find new outlets for Turkish steel will be one of the most important determinant factors effecting the export performance of the Turkish steel industry in 2013. In this respect, all kinds of activities targeting finding new markets should be actively encouraged and supported. Measures that are in the Action Plans of the Strategy Documents that aim improving the competitiveness of the Turkish steel industry in the domestic and export markets needs to be put into force without any delay.